Currency

Vast volatility continues to dominate the FX markets. The USD continues to gain strength off the back of rising oil prices. Whilst the GBP slides off the back of peak inflation forecast.

Analysts predict that the increase in oil prices will help the U.S. dollar, as growth is predicted to stay weak and inflation rates are expected to remain high in non-oil exporting nations. Following the longest winning streak in more than four years, oil prices are once again resting close to recent highs as OPEC+ officials extended supply restrictions through the end of 2023.

In the United States, GDP continues to outpace forecasts relative to China and Europe. As a result, the U.S economy may be less likely to suffer such stag-flationary conditions.

Beyond oil, Bank of America asserts that the dollar should benefit from predictions if the U.S. Federal Reserve will continue to keep interest rates higher, for a longer period of time. This being said, FOMC member Cohen comments that “the magnitude and timing of expected rate cuts should matter more for the USD than, say, a +/- 25bp difference in the peak.” The markets are still open to the possibility of another Fed rate hike before the cycle reaches its peak.

The British pound is testing crucial support against the US dollar ahead of UK GDP data due later Wednesday. The pound has been under performing against some of its peers in recent weeks. So far, there is no sign of reversal.

BoE Governor Andrew Bailey last week said interest rates might still rise further due to stick price pressures. However, the central bank is “much nearer” to ending its tightening cycle.

Key resistance levels:

- 1.2680

- 1.2548

- 1.250

Production & Freight Update

The container shipping market has been accustomed to cyclical patterns over the years. Specifically, witnessing an extraordinary peak in 2021 and 2022. During this period, liners enjoyed record rates and profits.

However, the current scenario is changing as consumers begin to cut back on their spending on higher-priced goods. This comes at a time when the global economy is grappling with an inflation shock and rapid interest rate hikes. Therefore, leading to a significant slowdown in demand.

Normally, at this time of the year, there is a slight uptick in demand. This is a result of some shipments being expedited ahead of China’s Golden Week holiday in early October. Ports experience congestion, and shipping firms grapple with the heightened demand for transportation services. This congestion can result in delays in loading and unloading cargo containers, impacting supply chains. During the holiday week itself, numerous factories and businesses close, resulting in a substantial decline in manufacturing and production activities. This, in turn, leads to a temporary reduction in cargo shipments, affecting both imports and exports. Ports and warehouses may encounter a slowdown or even partial closure, further disrupting freight operations. Following Golden Week, there is a surge in demand for transportation and logistics services as businesses resume operations. This abrupt increase in activity can result in congestion at ports, railway stations, and airports, potentially causing additional delays.

However, prices for shipping goods from Asia to Europe have begun to decrease again this week.

Therefore, the declining prices during this period could signal a reduction in demand. In turn, suggesting that the peak shipping season for this year has already passed.

The absence of proposed September General Rate Increases (GRIs) or Peak Season Surcharges thus far serves as further indications of declining shipment volumes. It suggests that carriers might be setting their sights on the next resurgence around the Lunar New Year in February.

Currently, Ningbo port is operating normally. The average vessel wait time is approx. 2-4 days, with good equipment availability. However, the space on the port is tight due to being occupied by empty units.

In the air cargo market, while the decline has shown some improvement in recent months, there are no indications that the industry will experience a peak season. Despite the optimism of a potential recovery in the last months of the year. The seasonal lull combined with overall low demand had been pushing volumes below pre-pandemic levels at some of Europe’s major hubs. A sluggish Chinese economy, reduced industrial output, an ongoing surplus of inventory, and various other factors are collectively dampening demand for freight transportation and orders.

However, with the Golden Week holiday approaching and the launch of new electronic products, the current air travel market has started to experience higher demand over the past week. Therefore, as a result airfares have started to increase. The China – N. Europe route air freight rates have seen a weekly price increase 5%.

Brexit

Since the United Kingdom’s departure from the EU’s Single Market and Customs Union, over two and a half years have passed. Therefore, revealing increasingly apparent negative consequences of Brexit on UK trade and the labour market. In terms of trade, once pandemic-related effects are accounted for, there is clear evidence of a significant reduction in EU-UK trade in both directions. However, there is a possibility of partial recovery over time as UK and EU businesses fully adapt to the new environment.

The share of trade in relation to GDP has also declined. Numerous small and medium-sized UK companies have withdrawn from engaging in trade with the EU. On the labour market front, the cessation of free movement for EU citizens has contributed to a recent upsurge in labour shortages. Particularly in sectors employing lower-skilled workers. Nonetheless, other factors beyond Brexit may have played a more substantial role in the decline of UK labour force participation. The long-term impacts remain uncertain. This includes how the slowdown in EU trade and migration might affect potential labour supply and future productivity.

Northern Ireland

Northern Ireland continues to lack a functioning government as the Democratic Unionist Party (DUP) withdrew its participation in protest the post-Brexit trading arrangements for the region. While the UK and EU reached the Windsor Framework to streamline procedures for goods entering Northern Ireland from Britain earlier in the year, the DUP is seeking further assurances.

However, the DUP has faced significant criticism, as many now believe that with the new Windsor Framework, Northern Ireland is in a highly advantageous position.

Despite the absence of local ministers, the responsibility of setting Northern Ireland’s budget for 2023/24 has fallen on the current Secretary of State for Northern Ireland, Chris Heaton-Harris. In addition, senior civil servants have taken on the task of managing departments in the region.

However, the financial situation is deteriorating, with many civil servants expressing the need for substantial additional funding, amounting to hundreds of millions of pounds, to sustain public services at their present level.

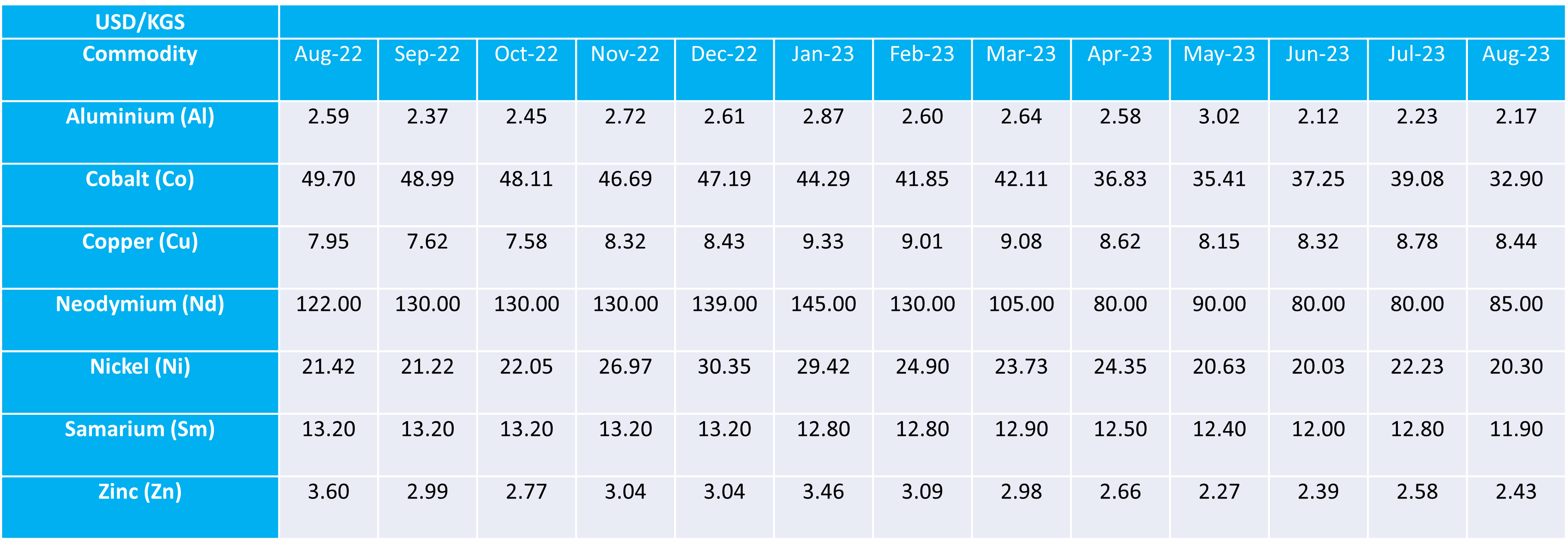

Commodity Rates

In August, we witnessed a noteworthy trend in the world of commodities as all tracked resources experienced a welcomed decrease. Cobalt, a vital component in various industries, saw a substantial decline of 6.18 USD/KGS, reflecting shifting market dynamics. Neodymium, another critical element, recorded a drop of 5 USD/KGS, indicating potential relief for industries reliant on its applications. Furthermore, Nickel observed a decline of 1.93 USD/KGS, followed by Samarium with a decrease of 0.90 USD/KGS. Copper, a bellwether for economic health, showed a modest decline of 0.34 USD/KGS, signaling potential adjustments in global trade. Zinc, essential for many sectors, saw a slight decrease of 0.15 USD/KGS. While Aluminium experienced a marginal dip of 0.06 USD/KGS.

As always, the metals markets remain unpredictable and subject to a range of factors.

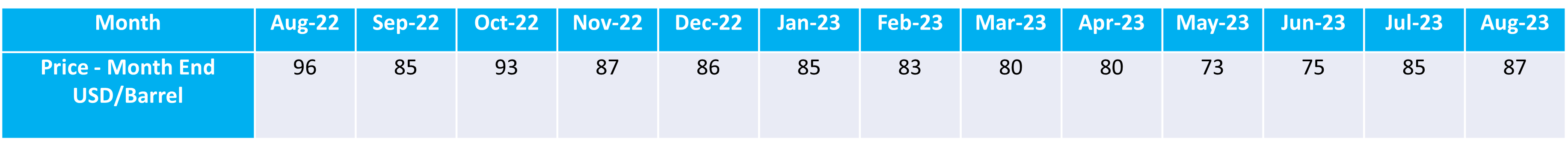

During the month of August, the Brent Crude oil market experienced a notable upward trajectory, with prices surging by an impressive 2 USD per barrel. This increase reflects the intricate interplay of global factors that influence oil markets, including supply and demand dynamics, geopolitical tensions, and economic conditions. Such a rise in Brent Crude prices can have significant ramifications for both energy producers and consumers, impacting everything from fuel costs to inflation rates. It serves as a reminder of the inherent volatility in the energy sector and the need for vigilance in monitoring global developments that can sway oil prices. We will continue to monitor the situation and keep you updated on any further developments.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity. Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.