Currency

The Pound Sterling will be guided by the commentaries from Bank of England Governor Andrew Bailey and other Monetary Policy Committee (MPC) members on the inflation and the interest rate outlook before Parliament’s Treasury Committee. Andrew Bailey and his teammates are expected to maintain a hawkish narrative on interest rates. This is because momentum in service inflation and wage growth is higher than what is required for bringing inflation down to the 2% target. Apart from that, robust Retail Sales data for January have indicated that the impact of hawkish stance on interest rates by the BoE is fading away. Also, an indication of higher spending by households would support the United Kingdom economy in coming out from a recession.

The USD Index struggles to deliver a strong recovery as Federal Reserve policymakers are confident that inflation is moving in the right direction. This is despite hotter-than-anticipated consumer price inflation and the Producer Price Index (PPI) data for January.

“GBP/USD is trading back in the mid-$1.25 region and has retested its 200-day moving average. Should this key support give way, we’re eying the 100-day moving average, located at $1.25, as the next downside target in the short-term,” says George Vessey, lead FX strategist at Convera, the payments firm.

Sources – FX street / Sterling Live

Production & Freight Update

The disruption in the Suez Canal continues to cause significant disruptions to global supply chains. With container ships diverting their routes around the Cape of Good Hope to steer clear of potential Houthi terrorist attacks near the Bab al-Mandab Strait. In the past week, a UK-registered cargo ship received catastrophic damages after being attacked off the coast of Yemen. All crew were safely evacuated. Within hours, a US-owned cargo ship reported a ‘missile attack’ in the same location and called for military assistance. No crew were harmed in either event.

The canal serves as the primary conduit for trade between Asia and Europe. Its growing significance in Asia-US east coast trade has been amplified by the limitations on draught imposed by the Panama Canal. Peter Sand, a chief analyst at Xenata has advised that this is the biggest disruption to global shipping since Covid. He has further warned that a flurry of surcharges from the carriers should be expected on goods currently in transit. The redirecting of vessels on to extended routes would incur additional carrier administration and operational expenses. However, the introduction of new surcharges might also be aimed at assisting carriers in preventing the continued decline in rates witnessed throughout 2023.

Efficient Supply Chains

In the past, supply chains aimed for efficiency by using Just-in-Time (JIT) methods to cut costs and optimise resources. This was under the belief that a smooth process led to a successful supply chain.

However, after major global events in recent years, the downside of overly efficient supply chains has been exposed.

It has become clear that there is a need to balance efficiency with resilience in supply chain management. Striking the right balance between resilience and agility is now crucial. The industry has seen a shift from a strict focus on efficiency to a more resilient approach. Businesses are reevaluating their supply chain strategies to prioritise adaptability over strict efficiency.

Container Freight Costs

In January, the expenses for container freight increased, as reported by supply chain advisory firm Drewry. However, in February, there has been a slight decrease in container shipping costs. Despite the extended sailing distances caused by the detour around Africa to bypass the Suez Canal, the market seems to have ample capacity to accommodate the increased demand in TEU-miles. This is evident in the stabilisation or levelling off of spot rates on major trade routes.

In Ningbo, port operations are currently running as normal. A vessel waiting time is 2-4 days and no current weather disruptions. However, space constraints are evident as the available area is occupied by empty units.

Airfreight

There is an intricate relationship between maritime disruptions and the subsequent ramifications on airfreight dynamics in the current global logistics landscape. Airfreight has seen a rise in demand as a result of the Red Sea conflict impact on Suez Canal shipping. The prevailing situation is characterised as volatile, leading to elevated freight rates, extended transit times, and disruptions in the supply chain. Thereby exerting pressure on airfreight capacity. The extended ocean transit times are expected to impact inventories significantly. Therefore, causing an immediate effect on airfreight capacities and it’s anticipated that there will be substantial price hikes on major trade routes due to these challenges. In turn, creating a dynamic where airfreight becomes more essential in meeting urgent delivery timelines.

In addition to this, air cargo rates for shipments originating from China experienced a notable increase, in the lead-up to the Lunar New Year with shippers hurrying to transport their goods before the holiday period.

Airport operations & hauliers are currently working as normal. There are no flight cancellations or weather disruptions, however space is tight due to the usual CNY holiday disruptions.

Weather

The primary driver of significant disruptions in supply chains for the upcoming year is anticipated to be weather-related incidents. This includes hurricanes, winter storms, wildfires, and floods. This forecast, derived from Everstream Analytics’ annual 2024 Risk Report, underscores that extreme weather events are poised to surpass other factors such as environmental regulations and trade wars. The report relies on a robust database encompassing both known and predicted events, leveraging a blend of human intelligence and advanced AI technology. This combination enables a comprehensive assessment of the potential risks and challenges faced by supply chains. Thus, emphasising the increasing significance of climate-related disruptions as a key determinant in shaping the resilience of global logistics networks.

The impact of extreme weather on maritime shipping operations is profound. Storms have the potential to alter planned routes, leading to delays in passage and necessitating smaller vessels to seek shelter. Such disruptions pose risks to cargo safety and result in shipment delays. Route deviations can cause delays in port arrivals, instances of ports being bypassed, and missed connections. In turn, creating a ripple effect that exacerbates congestion at destination ports. Despite the advancements in vessel technology to withstand adverse conditions, they remain susceptible to the effects of severe weather.

Impact on UK Airports

The productivity of UK airports is not exempt from the challenges of weather extremes. Adverse weather conditions and reduced daylight hours can impede the timely unloading of cargo from aircraft. In an industry where time is of the essence, even a one-hour delay can have significant consequences. Particularly for budget airlines where service punctuality may be less prioritised.

Impact on UK Road Networks

Extreme weather conditions also cast a shadow over the UK road network, causing additional congestion, especially on major transportation routes. Similar challenges extend across major routes in Europe when severe weather conditions prevail beyond the UK borders. The logistics industry must navigate these seasonal challenges to ensure the smooth flow of goods amidst the unpredictable winter weather.

Commodity Rates

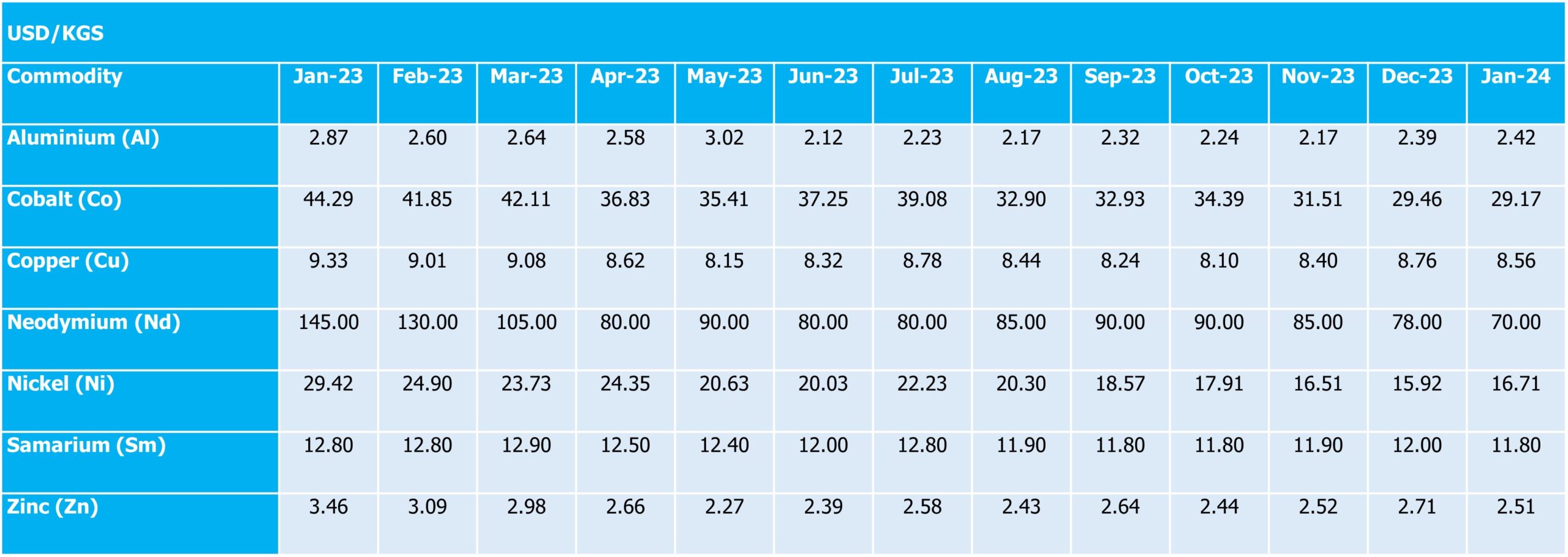

In our latest market overview for January, the tracked commodity table and graph showcase notable fluctuations in metal prices. Nickel saw a commendable increase of $0.79 USD/kg, while Aluminium modestly climbed by $0.03 USD/kg, reflecting subtle shifts in their respective markets. However, the spotlight falls on Neodymium, decreasing by $8 USD/kg, marking the month’s most substantial shift. Similarly, Cobalt and Copper prices receded by $0.29 USD/kg and $0.20 USD/kg, respectively, indicating market adjustments. Samarium and Zinc also faced downturns, each decreasing by $0.20 USD/kg. These movements underscore the dynamic nature of commodity markets. Therefore, highlighting the importance of staying abreast of trends for strategic positioning and investment planning.

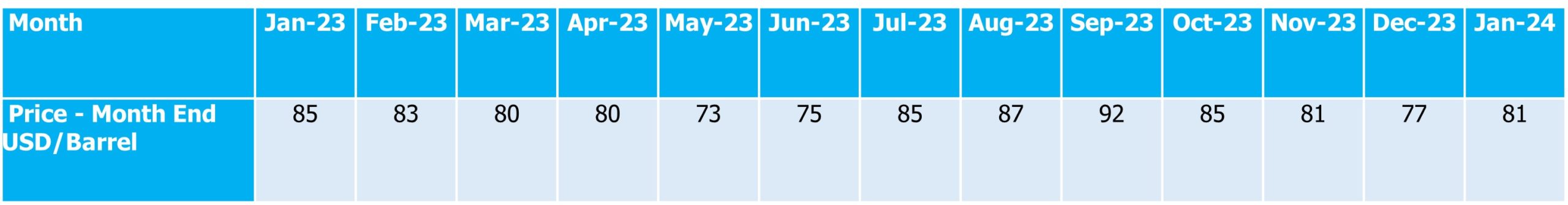

The month of January witnessed a significant upswing in the price of Brent crude oil, a key benchmark for global oil markets. The price per barrel surged by $4 USD, a notable increase that underscores the volatility and responsiveness of the energy sector to global economic and geopolitical factors. This rise can be attributed to a confluence of factors, including geopolitical tensions, shifts in supply-demand dynamics, and market speculations. Such an increase in Brent crude prices has wide-reaching implications, impacting everything from the cost of fuel to the broader economic landscape. For industries reliant on oil, this price hike serves as a reminder of the ever-present need for strategic planning and adaptability in the face of fluctuating energy markets. This trend also offers insights for investors and policy makers, who must navigate the complexities of energy economics while balancing environmental concerns and energy security.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively, fostering our long-term partnerships, managing expectations, and providing multiple solutions. Thus, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

Freight forwarders are trying their best to move goods on schedule without additional fees. However, in this unstable period, delays and additional charges can occur out of forwarders’ control. Goudsmit UK continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We would urge you to review your requirements for 2024 and in to 2025, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.