Currency

The technical outlook for GBP/USD in the months ahead is uncertain due to the ever-moving backdrop of US and UK interest rate expectations. The likely outcome is that GBP/USD moves slowly higher with a raft of US rate cuts already priced into the US dollar. While Sterling has further to go to price in recent dovish rate expectations.

Britain’s service sector grew at a faster pace in December than previously thought. Optimism among firms hit a seven-month high, according to the UK’s purchasing managers index release this week. This positivity is welcome news for the UK economy with recent commentary suggesting the UK is falling into a technical recession. A major factor for this has been the stuttering UK Manufacturing Sector. We’re likely to get a good snapshot into how the sector is performing on Friday January 12th when Manufacturing PMI and Industrial Production is released. Alongside a short-term GDP Health when November’s reading is released on the same date. A fall into the negative GDP territory could see the Pound sliding against it’s peers. Indicating that a recession becomes seemingly more likely.

Alongside this, Rishi Sunak says his “working assumption” is that the nation will go to the polls in general election later in the year. With the pound struggling to come to terms with a cost-of-living crisis and higher interest rates, what turmoil alongside this could a General Election cause?

UK Housing Market

The number of Mortgage approvals in the UK rose in November according to the Bank of England. While approvals rose to the highest level since June, they remained below the long-term average. House price data is released today by Halifax which should give some further insight to the housing market. In addition to the change in house prices over the past month. This data should further reveal the ongoing impact of higher interest rates. This may even give the Bank of England some food for thought when looking at their next move. It’s expected they will place a pause on raising rates.

Production & Freight Update

European importers are encountering a challenging beginning to the new year. They’re grappling with substantial delays and uncertainty regarding the arrival of their containers from Asia.

The crisis in the Suez Canal is causing significant disruptions to global supply chains. Container ships are diverting their routes around the Cape of Good Hope to steer clear of potential Houthi terrorist attacks near the Bab al-Mandab Strait. The canal serves as the primary conduit for trade between Asia and Europe. Its growing significance in Asia-US east coast trade has been amplified by the limitations on draught imposed by the Panama Canal.

Peter Sand, a chief analyst at Xenata has advised that this is the biggest disruption to global shipping since Covid. He has further warned that a flurry of surcharges from the carriers should be expected on goods currently in transit. The redirecting of vessels on to extended routes would incur additional carrier administration and operational expenses. However, the introduction of new surcharges might also be aimed at assisting carriers in preventing the continued decline in rates throughout 2023.

In recent weeks, spot rates have more than doubled to approx. $3,000 per 40ft. Many agencies believe container rates could spike to highs not seen since early 2022. If the Red Sea crisis continues to disrupt liner networks.

Container Capacity

There doesn’t appear to be any issues with capacity at this time, due to the introduction of new equipment at the end of 2024. However, potential shortages due to the positioning of equipment may become apparent by the end of the month. As Chinese New Year approaches it is expected that this will become a significant challenge. The shipping forwarder Ligentia has advised that they are ‘now preparing for this disruption to impact supply chains through Q1 and into Q2 2024’.

Vessels set to depart China in the first half of January are nearly at full capacity. Those scheduled for the second half of the month are also approaching their limits. Consequently, available space is constrained and expected to further tighten as vessels face delays in returning to Asia as per their schedules. The most recent information suggests a projected 20-30% reduction in capacity from the third week of January. This situation may lead to an uptick in blank sailings as we approach the Chinese New Year period on February 10, 2024.

Anticipate ongoing scheduling challenges in the coming months, proactive planning is strongly recommended.

In Ningbo, port operations are currently running as normal, with a vessel waiting time of 2-4 days. However, there is a shortage of 20’GP 7 40’HQ containers at MSK this week. Fortunately, there are no weather disruptions, but space constraints are evident as the available area is occupied by empty units.

Airfreight

There is an intricate relationship between maritime disruptions and the subsequent ramifications on airfreight dynamics in the current global logistics landscape. Airfreight has seen a rise in demand as a result of the Red Sea conflict impact on Suez Canal shipping. The prevailing situation is characterised as volatile. Thus, leading to elevated freight rates, extended transit times, and disruptions in the supply chain. Thereby exerting pressure on airfreight capacity. The extended ocean transit times are expected to impact inventories significantly. Therefore, causing an immediate effect on airfreight capacities. It’s also anticipated that there will be substantial price hikes on major trade routes due to these challenges. In turn, creating a dynamic where airfreight becomes more essential in meeting urgent delivery timelines.

In response to the evolving circumstances, it is likely that airlines will introduce additional airfreight capacity. This should become available between mid-January and early February, particularly originating from China. This anticipated increase in airfreight capacity aims to address the heightened demand and potential supply chain constraints.

Airport operations & hauliers are currently working as normal, with no flight cancellations or weather disruptions.

Weather

The primary driver of significant disruptions in supply chains for the upcoming year is anticipated to be weather-related incidents. Including hurricanes, winter storms, wildfires, and floods. This forecast, derived from Everstream Analytics’ annual 2024 Risk Report, underscores that extreme weather events are poised to surpass other factors such as environmental regulations and trade wars. The report relies on a robust database encompassing both known and predicted events, leveraging a blend of human intelligence and advanced AI technology. This combination enables a comprehensive assessment of the potential risks and challenges faced by supply chains. Thusm, emphasising the increasing significance of climate-related disruptions as a key determinant in shaping the resilience of global logistics networks.

The impact of extreme weather on maritime shipping operations is profound. Storms have the potential to alter planned routes, leading to delays in passage and necessitating smaller vessels to seek shelter. Such disruptions pose risks to cargo safety and result in shipment delays. Route deviations can cause delays in port arrivals, instances of ports being bypassed, and missed connections. Therefore, creating a ripple effect that exacerbates congestion at destination ports. Despite the advancements in vessel technology to withstand adverse conditions, they remain susceptible to the effects of severe weather.

Impact on UK Airports & Road Network

The productivity of UK airports is not exempt from the challenges of weather extremes. Adverse weather conditions and reduced daylight hours can impede the timely unloading of cargo from aircraft. In an industry where time is of the essence, even a one-hour delay can have significant consequences. Particularly for budget airlines where service punctuality may be less prioritised.

Extreme weather conditions also cast a shadow over the UK road network, causing additional congestion, especially on major transportation routes. Similar challenges extend across major routes in Europe when severe weather conditions prevail beyond the UK borders. The logistics industry must navigate these seasonal challenges to ensure the smooth flow of goods amidst the unpredictable winter weather.

Commodity Rates

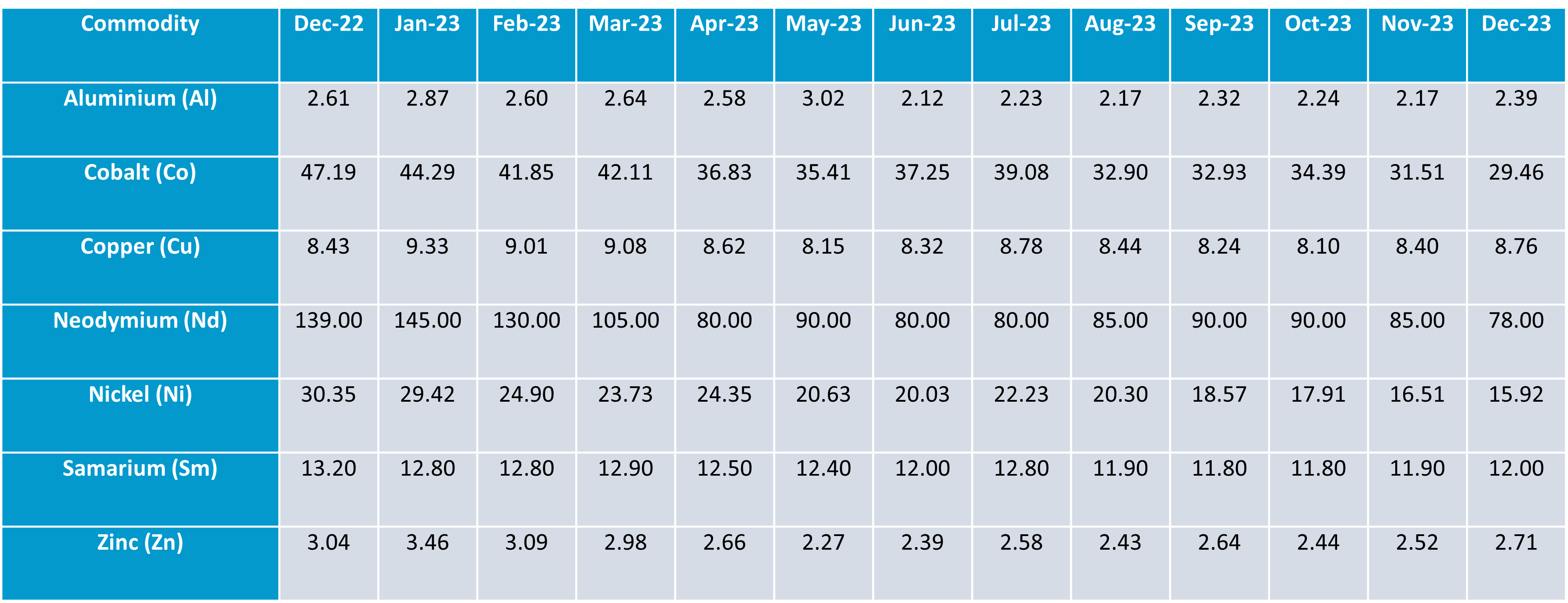

The tracked commodity rates experienced significant fluctuations as the month of December drew to a close. Notably, there was a marked increase in the prices of several metals. Copper saw a substantial rise of $0.36 per kilogram, indicating a strong demand or possibly a tightening of supply in the market. Similarly, Aluminium and Zinc also witnessed considerable hikes in their rates, increasing by $0.22 and $0.19 per kilogram respectively. This could be attributed to various factors including industrial demand, market speculations, or changes in global supply chains. In the rare earth metals sector, Samarium’s price went up by $0.10 per kilogram. This might reflect specific market dynamics or technological advancements driving the demand.

Conversely, the end of December saw a notable decline in the price of Neodymium, plummeting by a significant $7 per kilogram. This substantial drop could be due to oversupply issues, reduced demand in key industries, or shifts in global trading policies affecting rare earth metals. Additionally, Cobalt and Nickel also experienced decreases in their rates, falling by $2.05 and $0.59 per kilogram respectively. These declines might indicate changes in industrial usage, shifts in battery manufacturing demands, or alterations in geopolitical scenarios impacting mining and supply.

Overall, these changes in commodity rates reflect the dynamic and often unpredictable nature of global markets, influenced by a complex interplay of supply-demand balances, technological shifts, and international economic trends.

Brent Crude Oil

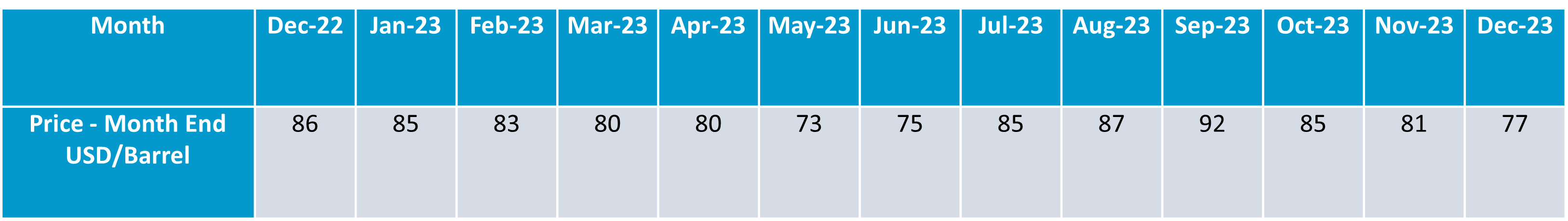

As December concluded, the global energy market witnessed a notable shift in the pricing of Brent crude oil. This crucial commodity experienced a decline, decreasing by $4 per barrel. Such a downward adjustment in price could be attributed to a variety of factors. These might include changes in global oil supply, possibly due to increased production or reduced export restrictions from key oil-producing nations. Additionally, fluctuations in global demand, driven by economic indicators or shifts in energy consumption patterns, could also play a significant role.

This decrease might also reflect broader market sentiments, influenced by geopolitical events, trade negotiations, or changes in environmental policies affecting the oil industry. The reduction in the price of Brent crude oil is significant as it impacts a wide range of sectors from transportation to manufacturing. Often it also serves as an indicator of broader economic health and energy market stability.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively, fostering our long-term partnerships, managing expectations, and providing multiple solutions. Thus, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

Freight forwarders are trying their best to move goods on schedule without additional fees. However, in this unstable period, delays and additional charges can occur out of forwarders’ control. Goudsmit UK continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We would urge you to review your requirements for 2024 and in to 2025, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.