Currency

GBPUSD has fluctuated between gains and losses so far this week. This is keeping in line with the rangebound nature of markets so far. GBP/USD has been moving up and down in a tight range above 1.2600 early Wednesday following Tuesday’s indecisive action.

The Bank of England raised the UK Bank Rate by 25 basis points to 4.5%. This is the 12th consecutive hike in a row. The MPC voted 7-2 for the hike with two members, Swati Dhingra and Silvana Tenreyro, voting for rates to remain unchanged at 4.25%. The BoE said that today’s decision was ‘conditioned on a market-implied path for Bank Rate that peaks at around 4¾% in 2023 Q4 before ending the forecast period at just over 3½%’.

The BoE said that further monetary policy tightening ‘would be required’ if price pressures remain persistent. They further noted that they’re ‘continuing to address the risk of more persistent strength in domestic price and wage setting. As represented by the upward skew in the projected distribution for CPI inflation’. The UK central bank said that they expect CPI to fall sharply from April.

BoE governor Andrew Bailey gave an upbeat outlook for UK growth. The BoE expects UK GDP to be flat in H1 and grow modestly in the rest of the year. ‘Economic activity has been less weak than expected in February. The Committee now judges that the path of demand is likely to be materially stronger than expected in the February Report. Albeit still subdued by historical standards.’

Sterling went into the policy decision trading at 1.2575 against the US dollar. The pair touched 1.2600 post-decision and currently eye the multi-month high around 1.2667/1.2680.

Sources – Daily FX & FX Street

Production Update

Chinese manufacturing continues to contract as the global demand outlook shows little sign of any short-term improvement. The developed nations are still facing inflationary and recessionary pressures. However, some believe that inflation has now peaked following the supply shocks emanating from:

- The Covif 19 Pandemic

- Russia’s Invasion of Ukraine

- Rising Energy Costs

In a concerted effort to curb inflation, major central banks are actively pursuing measures such as:

- Raising Interest Rates

- Reducing their Holdings of Assets

Consequently, financial conditions are becoming more restrictive.

As a consequence, there is a general deceleration in both household and business expenditure. The capacity that was previously impeded by port congestion is now resurfacing in the market as the bottlenecks gradually alleviate.

Freight Update

HSBC noted in mid-April that the downward trend in freight rates has slowed down compared to December 2022. They expressed their expectation that rates would stabilise at their present levels.

However, the increased confidence in the market for the year ahead remains. There are predictions of a surge in demand and trade from the second half of 2023. A sentiment supported by HSBC who maintains its outlook that container volumes will be bolstered by inventory restocking across the globe.

The reliability of container line schedules is steadily improving and approaching levels seen before the pandemic.

Sea-Intelligence analysts, reported that the figure for March 2023 was comparable to the same month in 2020, which was just ahead of the significant disruptions cause by the Covid lockdowns across many countries.

Ports in China are operating without any major issues at present. Vessel space is currently tight at Ningbo port, due to a high level of empty units occupying dock space. The current wait time is around 2-4days.

Airport operations are relatively stable, with good capacity and no weather disruptions or flight cancellations.

The market is undergoing a stabilisation phase, with rates expected to remain higher than those observed in Q1. Demand has rebounded and is maintaining a relatively steady level. Certain freighter capacity, particularly on the Transpacific route, is being retired. However, as the summer season approaches, the addition of passenger capacity is anticipated to keep the overall capacity (both freighter and passenger) relatively stable. This is expected to maintain a favourable balance between supply and demand in the market.

Brexit

The UK government has decided to abandon its plans to eliminate numerous retained EU laws by the end of the year, with the removal of the controversial ‘sunset clause’ of the Retained EU Law (REUL) bill which would see UK laws brought over from the EU automatically expire after December 2023. There had been much criticism of the ‘sunset clause’ with fears of the potential risks that the tight deadline posed to both businesses and consumers. These stemmed from concerns that civil servants would face challenges in identifying all the relevant legislation and implementing the required modifications within the given timeframe. This raised concerns about the potential loss of vital protections in crucial areas such as food safety and trade.

According to the government’s website, only 20% of the nearly 5,000 relevant bills had been dealt with by early May. Logistics UK expressed its appreciation for the decision and had previously written to the Prime Minister, urging careful consideration of the potential “costs and risks” to the supply chain that could arise from rushing the deadline. Kate Jennings, Director of Policy at Logistics UK, stated, “Logistics UK has maintained constant communication with the government regarding the Retained EU Law Bill and its potential impact on our industry. We recently raised our members’ concerns in a letter addressed to the Prime Minister. The change in approach announced by the Secretary of State is a step towards facilitating the process. However, our industry still requires clarification on which specific aspects will be reviewed to ensure the ongoing security of the supply chain.”

Northern Ireland

Northern Ireland remains without a functioning government, after the DUP withdrew in protest over the post-Brexit trading arrangements for Northern Ireland. Although the UK and EU recently reached the Windsor Framework to reduce red tape on goods entering Northern Ireland from Britain, the DUP is seeking further assurances. However, the DUP have faced tough criticism. Many now believe that with the new Windsor Framework, Northern Ireland is in a hugely advantageous position. With the absence of local ministers, the responsibility of setting Northern Ireland’s 2023/24 budget has fallen on the current NI secretary of state Chris Heaton-Harris. Additionally, senior civil servants have taken on the task of running departments in the region.

Commodities

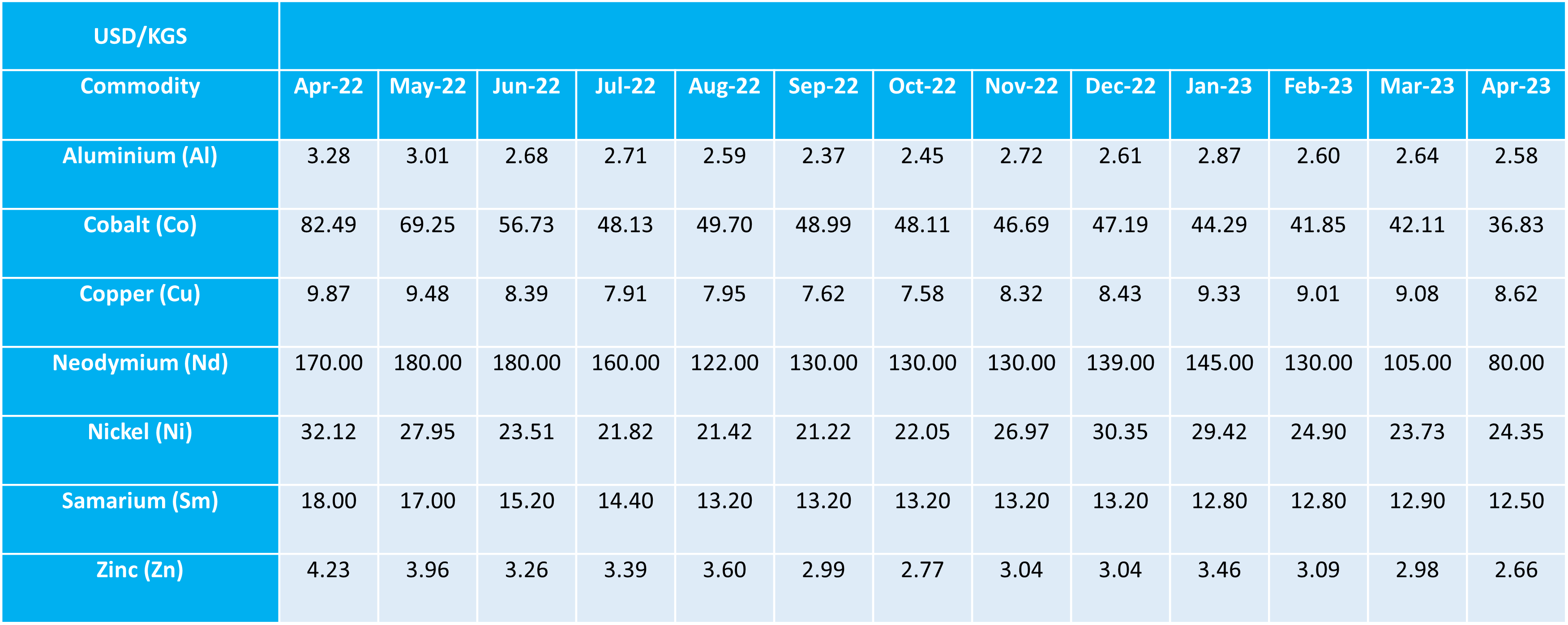

In the latest tracked commodity update in April, the market experienced a general decrease in prices across various commodities tracked, with one notable exception. Nickel saw a modest increase of 0.62 USD/KGS. The most significant drop was seen in Neodymium, which experienced a substantial decrease of 25 USD/KGS. Other metals also experienced decreases in their respective prices. Aluminium dropped by 0.06 USD/KGS, Cobalt by 5.28 USD/KGS, Copper by 0.46 USD/KGS, Samarium by 0.40 USD/KGS, and Zinc by 0.32 USD/KGS. These declines may reflect fluctuations in global supply and demand dynamics, geopolitical factors, or other market forces impacting the commodities sector.

As always, the metals markets remain unpredictable and subject to a range of factors.

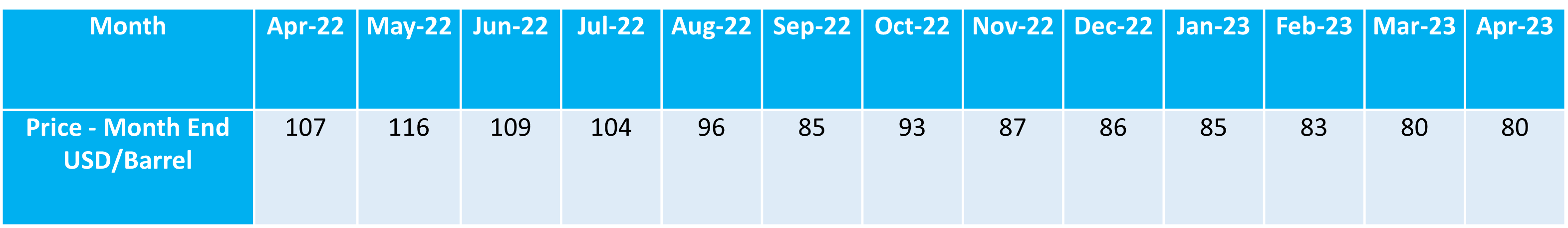

In April, Brent crude oil experienced a small but noteworthy increase in price, rising by 0.44 USD per barrel. This upward movement in the price of Brent crude, a benchmark for global oil prices, could be influenced by a range of factors. These might include geopolitical tensions, changes in global oil supply and demand dynamics, or shifts in economic conditions affecting the oil market. The modest increase in Brent crude oil price during April underscores the volatility and sensitivity of the oil market. Even slight fluctuations can have significant implications for energy prices, industries, and economies worldwide.

We will continue to monitor the situation and keep you updated on any further developments.

Goudsmit UK Response

Goudsmit UK continue to communicate with all customers proactively in order to manage expectations. We provide multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

We’ll continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning. We would request that you review your current requirements and advise of any issues asap. We’d urge you to review your requirements for 2023 through to 2024, at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10mths of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.