Welcome to the Goudsmit UK Market Update for June! As we journey through the complex world of global trade, this month’s update offers insights into the latest trends and developments impacting various sectors. From currency fluctuations to changes in commodity markets, and updates on production and freight, stay informed with our thorough analysis.

Currency Update:

Lowest exchange rate of May 2024: 1.2497

Highest exchange rate of May 2024: 1.277

Average exchange rate in May 2024: 1.2637

Production & Freight Update

The China to UK sea freight route remains a critical artery for global trade, navigating a dynamic landscape in June 2024. As global shipping stabilizes post-pandemic, there has been a notable recovery in container volumes moving from China to the UK.

This resurgence is driven by a robust demand for consumer goods, particularly in sectors like electronics, apparel, and household items. Freight rates have experienced volatility, with recent months showing a slight decline as supply chain bottlenecks ease and additional shipping capacity becomes available. However, the cost of shipping remains influenced by fuel price fluctuations and ongoing disruptions in certain trade lanes.

Operationally, the route faces several challenges and adjustments. The lingering impacts of the Russia-Ukraine conflict have altered some shipping lanes, leading to longer transit times as vessels reroute to avoid conflict zones like the Red Sea.

Additionally, economic policies in China aimed at boosting exports are having mixed effects on shipping volumes. Ports in the UK are increasingly adopting digital technologies and automation to enhance efficiency and handle the high volumes of incoming cargo from China.

Sustainability efforts are also gaining momentum, with initiatives to reduce carbon emissions and improve the environmental footprint of sea freight operations. As these factors interplay, the China-UK sea freight route is poised for continued adaptation and growth in the evolving global trade environment.

Ningbo Port Operations

In Ningbo, overall port operations are currently running as normal, with a vessel waiting time of 2-4 days and no weather disruptions. Capacity is normal; however, most carriers are experiencing equipment shortages.

Airfreight: China to UK

The China-UK airfreight route continues to flourish in mid-2024, driven by strong demand and recovering post-pandemic trade. Air cargo volumes have surged, supported by a significant rise in e-commerce shipments as UK consumers increasingly shop online for Chinese goods.

The market is also seeing higher airfreight rates due to a combination of robust demand and limited capacity, although the recent expansion of cargo space by airlines is helping to moderate these rates. Technological advancements like automation and improved tracking systems are streamlining operations, enhancing efficiency and reducing costs for shippers.

Operationally, the route faces challenges from geopolitical tensions and economic fluctuations. The ongoing Russia-Ukraine conflict and trade disputes impact supply chains and operational costs. Meanwhile, China’s economic policies aimed at boosting exports are influencing cargo volumes.

Airlines are responding with increased direct flight offerings between China and the UK, and there’s a growing integration of airfreight with other transport modes to enhance flexibility and cost-effectiveness. As these dynamics unfold, the China-UK airfreight corridor remains a vital link in global trade, poised for further growth and adaptation.

Air Cargo Market Trends

In May, global air cargo spot rates saw a year-on-year increase of 9%, reaching $2.58 per kilogram. This marks the second consecutive month of growth. Additionally, demand rose by 12% compared to the same period last year.

Airport operations and hauliers are currently working as normal, with no flight cancellations or weather disruptions. Space remains tight, which is one of the driving factors keeping rates high.

Commodity Market:

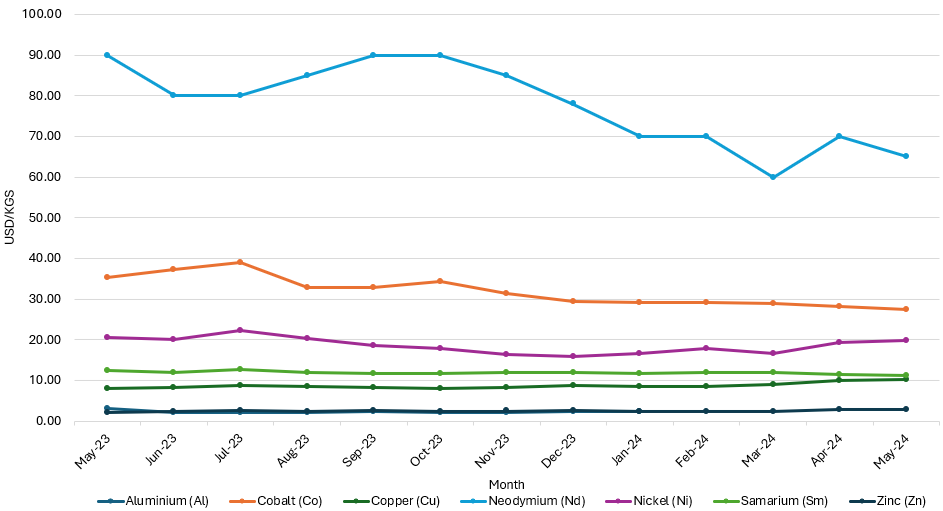

In May, the commodity market experienced a variety of price changes, reflecting the dynamic nature of the industry. Aluminium saw its price rise from $2.61 USD/KG in April to $2.68 USD/KG, while Cobalt continued its downward trend, decreasing from $28.21 USD/KG to $27.59 USD/KG.

Neodymium also saw a notable decrease in price, falling from $70.00 USD/KG to $65.00 USD/KG. Zinc saw a slight increase in its price, rising from $2.95 USD/KG to $2.99 USD/KG.

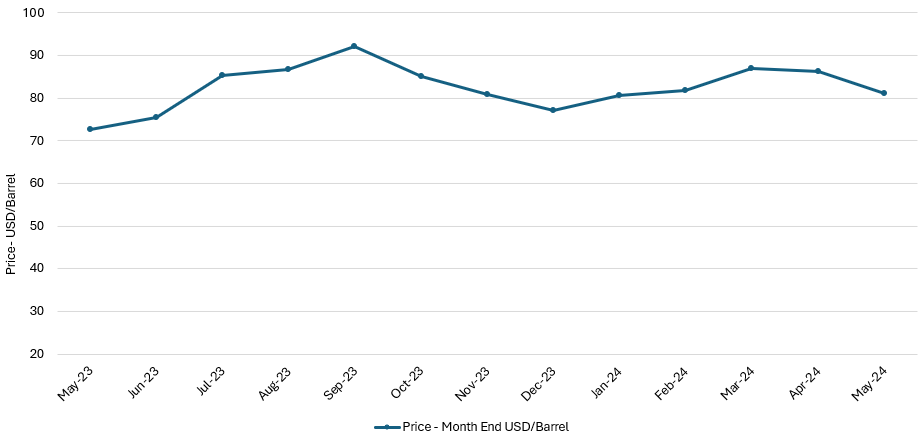

In the Brent crude oil market, May witnessed a sizable drop in price, with crude oil returning to levels seen at the start of the year at $81 USD per barrel.

Download the latest commodity rates here.

GUK Response

Goudsmit UK continue to communicate with all customers proactively, fostering our long-term partnerships, managing expectations, and providing multiple solutions, allowing our customers to make conscious decisions when balancing cost versus supply chain risk.

Freight forwarders are trying their best to move goods on schedule without additional fees, but in this unstable period, delays and additional charges can occur out of forwarders’ control. We therefore continue to advise all customers at the point of quotation and order confirmation of the extended lead times so that they can be factored in when planning.

We would request that you review your current requirements and advise of any issues as soon as possible, and would urge you to review your requirements for 2024 and into 2025 at the earliest opportunity.

Whilst freight delays are unavoidable at this time, we are working with our customers by holding larger volumes of UK stock for longer and would encourage that a minimum of 8-10 months of buffer stock is considered when re-ordering new production to help reduce the impact of freight delays and lessen the potential requirement for costly airfreight.